TAX-DEFAULTED PROPERTY

Made pursuant to Section 3361 & 3362

Revenue and Taxation Code

Pursuant to Revenue and Taxation Code sections 3691 and 3692.4, the following conditions will, by operation of law, subject real property to the tax collector’s power to sell.

- All property for which property taxes and assessments have been in default for five or more years.

- All property that has a nuisance abatement lien recorded against it and for which property taxes and assessments have been in default for three or more years.

- Any property that has been identified and requested for purchase by a city, county, city and county, or nonprofit organization to serve the public benefit by providing housing or services directly related to low-income persons and for which property taxes and assessments have been in default for three or more years.

The parcels listed herein meet one or more of the criteria listed above and thus, will become subject to the tax collector’s power to sell on July 1, 2025 at 12:01 a.m., by operation of law. The tax collector’s power to sell will arise unless the property is either redeemed or made subject to an installment plan of redemption initiated as provided by law prior to 5:00 p.m. on June 30, 2025. The right to an installment plan terminates at 5:00 p.m. on June 30, 2025, and after that date, the entire balance due must be paid in full to prevent sale at public auction.

The right of redemption survives the property becoming subject to the power to sell, but it terminates at 5:00 p.m. on the last business day prior to the date of the sale by the tax collector.

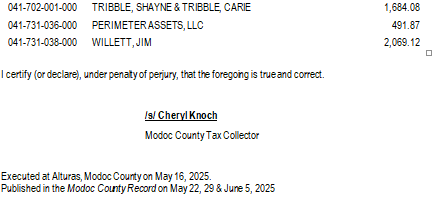

All information concerning redemption or the initiation of an installment plan of redemption will be furnished, upon request, by Cheryl Knoch, Modoc County Tax Collector, 204 South Court Street, Alturas, California 96101. Phone number is (530) 233-6223.

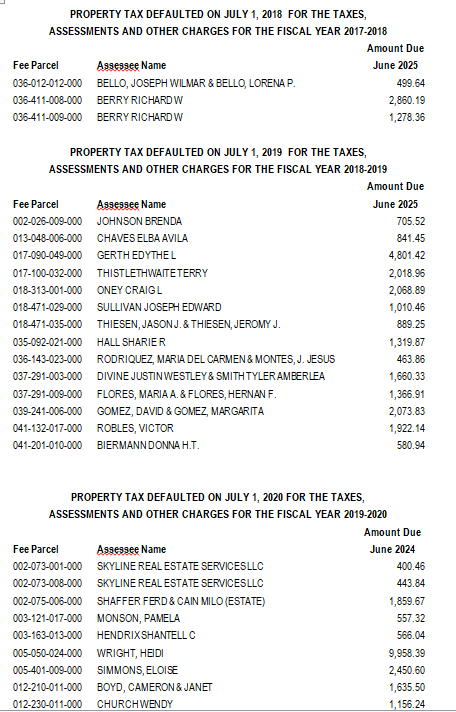

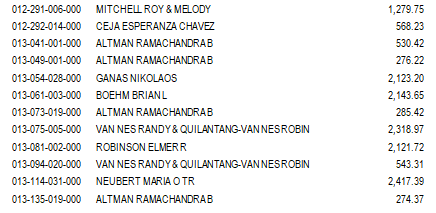

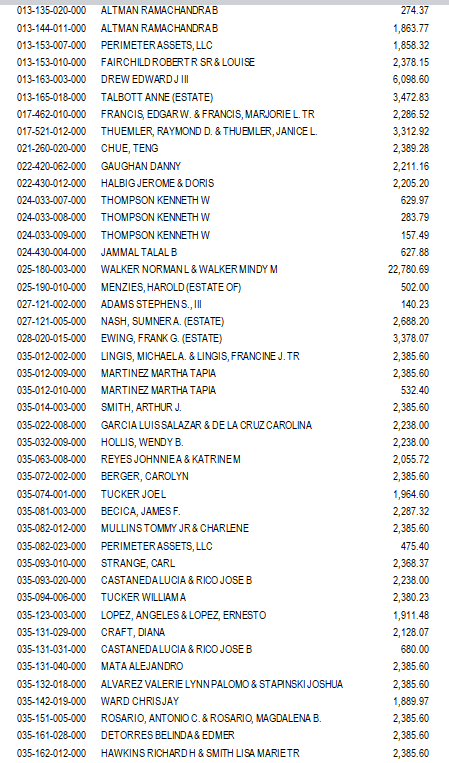

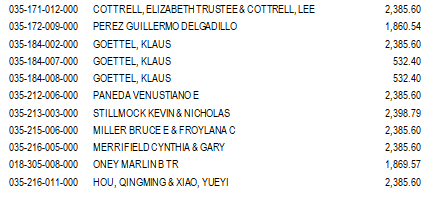

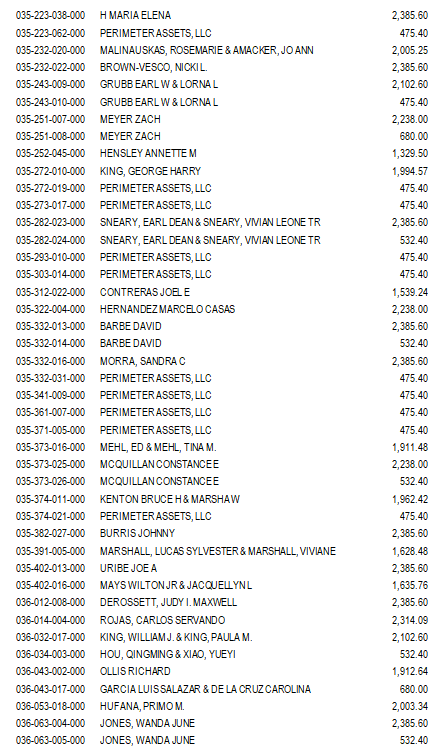

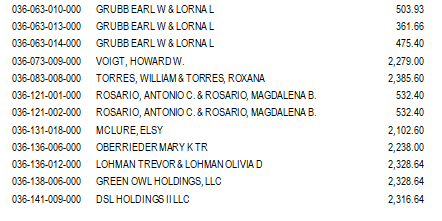

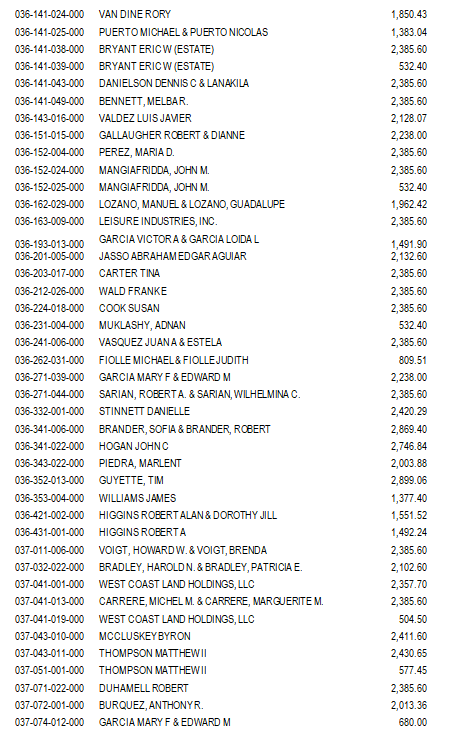

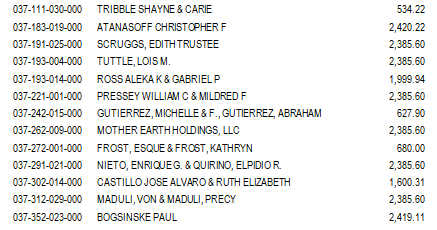

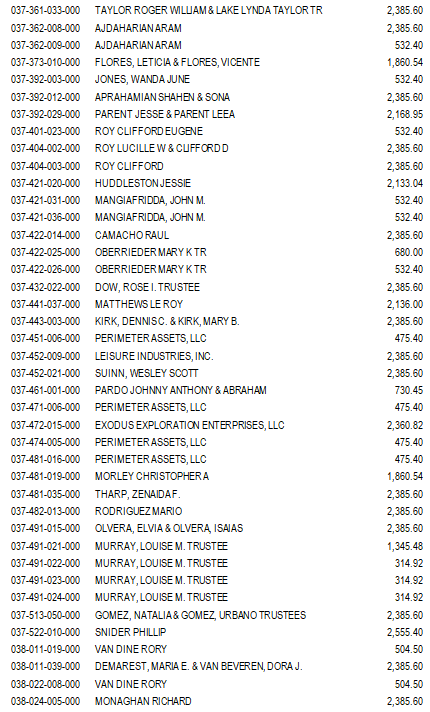

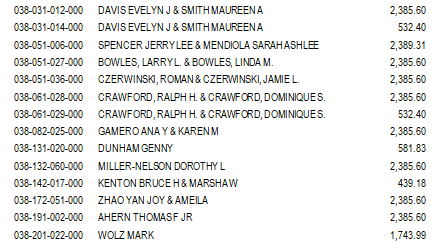

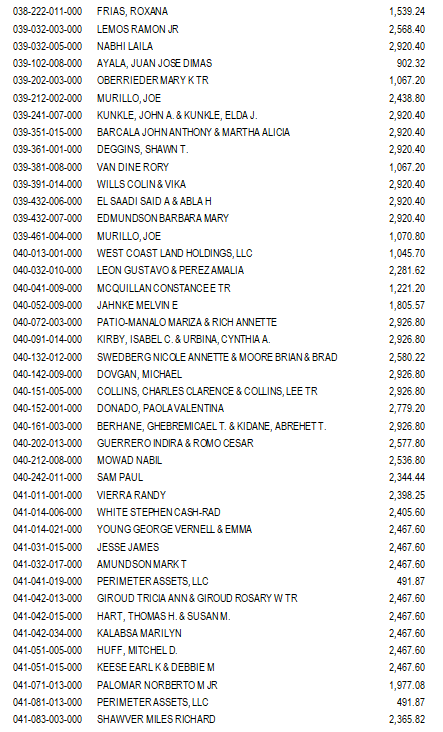

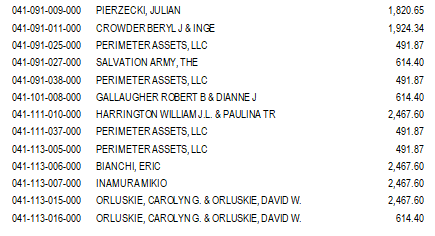

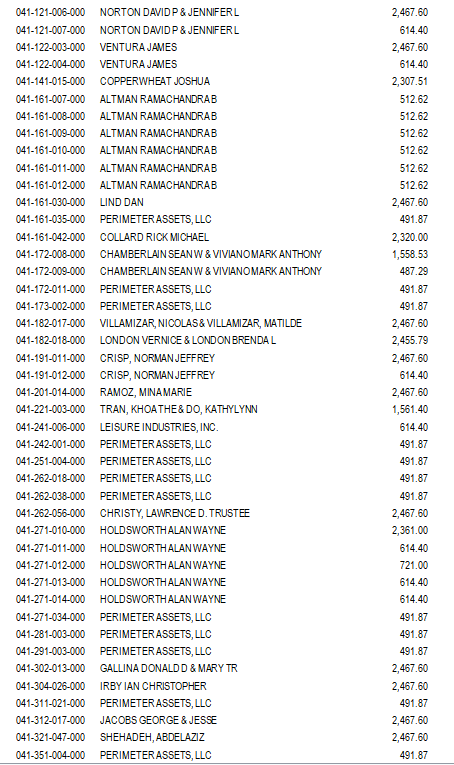

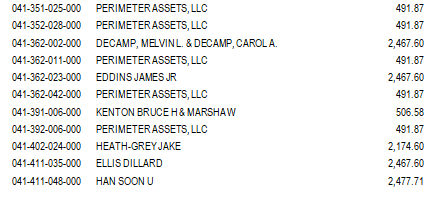

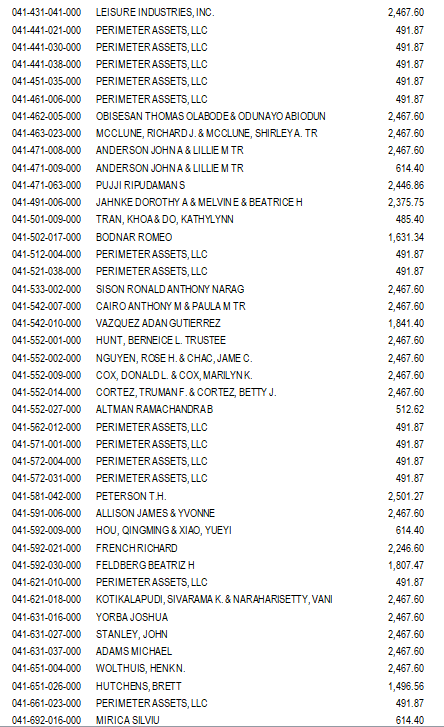

The amount to redeem, including all penalties and fees, as of June, 2025 is shown opposite the parcel number and next to the name of the assessee.

PARCEL NUMBERING SYSTEM EXPLANATION

The Assessor’s Parcel Number (APN), when used to describe property in this list, refers to the assessor’s map book, the map page, the block on the map, if applicable, and the individual parcel on the map page or in the block. The assessor’s maps and further explanation of the parcel numbering system are available in the Assessor’s office.