Made pursuant to Section 3692,

Revenue and Taxation Code

On January 28, 2025, I, Cheryl Knoch, Modoc County Tax Collector, was directed to conduct a public auction sale by the Board of Supervisors of Modoc County, California. The tax-defaulted properties listed below are subject to the tax collector’s power of sale.

The sale will be conducted at www.bid4assets.com/Modoc starting Friday May 16, 2025 at 8:00 a.m. PT through Monday May 19, 2025, as a public auction to the highest bidder for not less than the minimum bid as shown on this notice. If no bids are received on a parcel during the course of the sale, the minimum bid may be lowered, at the tax collector’s discretion. Research the item prior to bidding. Due diligence research is incumbent on the bidder. The winning bidder is legally obligated to purchase the item.

A computer workstation will be available at the Treasurer and Tax Collector’s office, 204 South Court Street, Room 101, Alturas, California. There is also a Public Computer and Internet access available at the Alturas, Adin, Cedarville and Lookout branches of the Modoc County Library.

Bids may be submitted via the Internet or by fax. Pre-registration is required. Register on-line at www.bid4assets.com or by fax using an offline bid form. For an offline bid form, contact the Tax Collector’s office at (530) 233-6223 or Bid4Assets at 1-877-427-7387.

Bidders must submit a refundable deposit of $500.00 + $35 processing fee to participate in the auction. Bid deposits must be in the form of a wire transfer or certified check and must be in the custody of Bid4Assets no later than Monday, May 12, 2025. The $500 deposit will be applied to the successful bidder’s purchase price.

Full payment of winning bid(s) and deed information indicating how title should be vested is required within 3 business days after the end of the sale. Only wire transfers and cashier checks will be accepted for payment. A California transfer tax will be added to and collected with the purchase price and is calculated at $.55 per each $500 or fraction thereof.

All property is sold as is. The county and its employees are not liable for the failure of any electronic equipment that may prevent a person from participating in the sale.

The right of redemption will cease Thursday, May 15, 2025 at the close of business (5:00 p.m. PT) and properties not redeemed will be sold. If a parcel is not sold, the right of redemption revives up to the close of business of the last business day prior to the next scheduled sale.

Parcels that are not sold in the May 16-19, 2025 sale will be re-offered at 8:00 a.m. PT on June 13, 2025 to the closing time on June 16, 2025 on the www.bid4assets.com website.

If the properties are sold, parties of interest, as defined in California Revenue and Taxation Code Section 4675, have a right to file a claim with the county for any excess proceeds from the sale. Excess proceeds are the amount of the highest bid in excess of the liens and costs of the sale that are paid from the sale price. Notice will be given to parties of interest, pursuant to law, if excess proceeds result from the sale.

More information may be obtained by contacting the Tax Collector at 204 South Court Street, Alturas, California 96101, phone number (530) 233-6223, Modoc County’s website: www.co.modoc.ca.us – Departments – Tax Collector, click on link to Tax Sales, or on the web site: www.bid4assets.com/modoc.

PARCEL NUMBERING SYSTEM EXPLANATION

The Assessor’s Parcel Number (APN) when used to describe property in this list refers to the Assessor’s map book, the map page, the block on the map, if applicable, and the individual parcel number on the map page or in the block.

A parcel number, such as 048-523-013-000, is analyzed as follows: 048 would be the map book number, 523 would be map page 52, and block 3 (if the “3” were a “0”, that page would not contain a block), 013 is the parcel number, and 000 is a coded suffix to the parcel number denoting the interest held in parcel 013.

The suffixes used in conjunction with the parcel number are as follows:

-000 Total ownership of interest and rights

The maps referred to are available for inspection in the office of the Assessor, 204 South Court Street, Alturas, California, or on the web site: www.bid4assets.com/modoc.

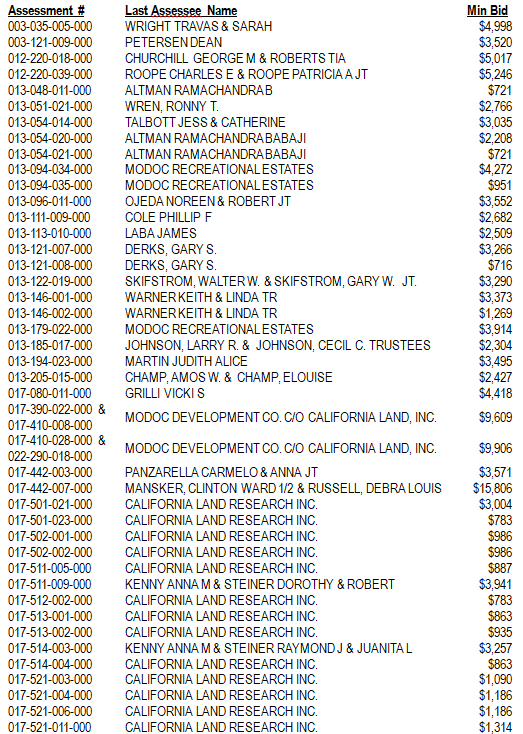

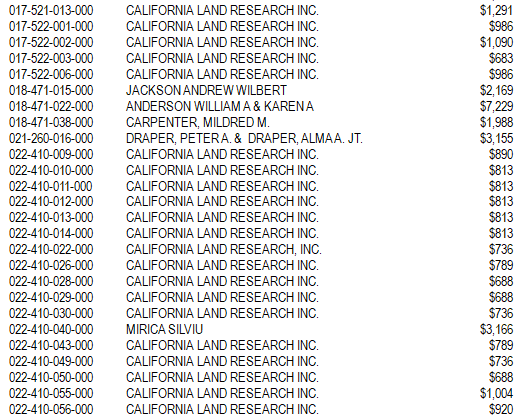

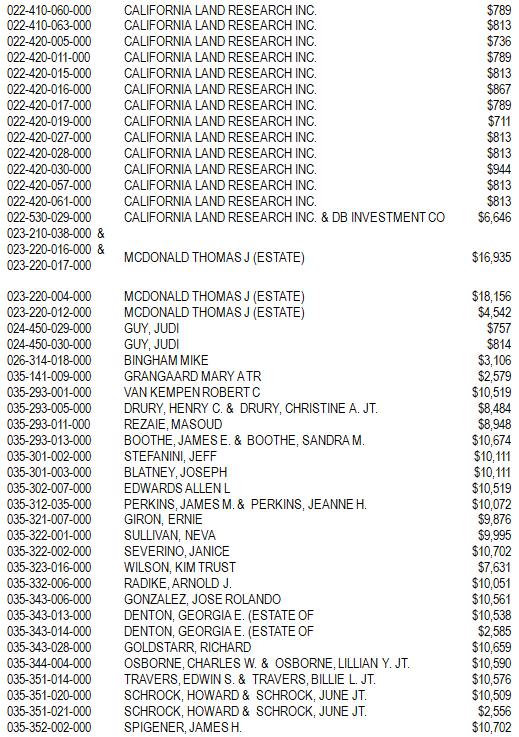

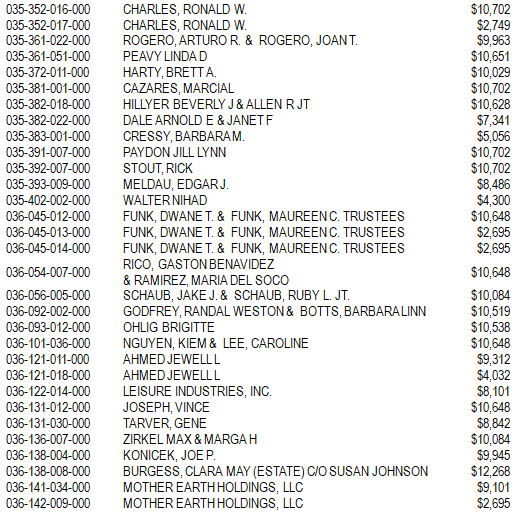

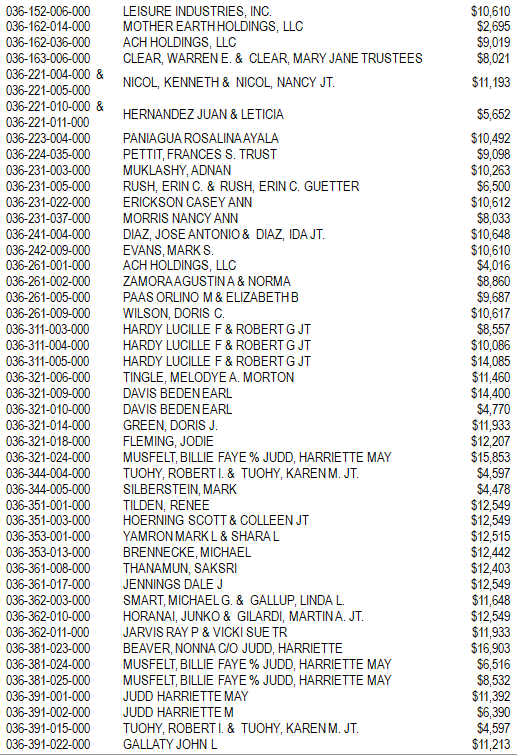

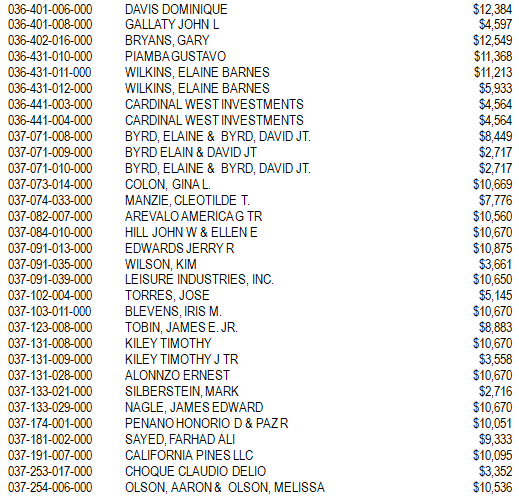

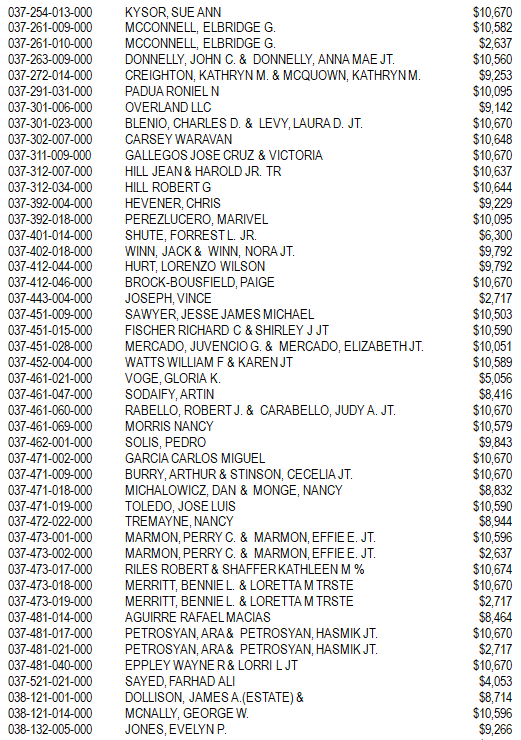

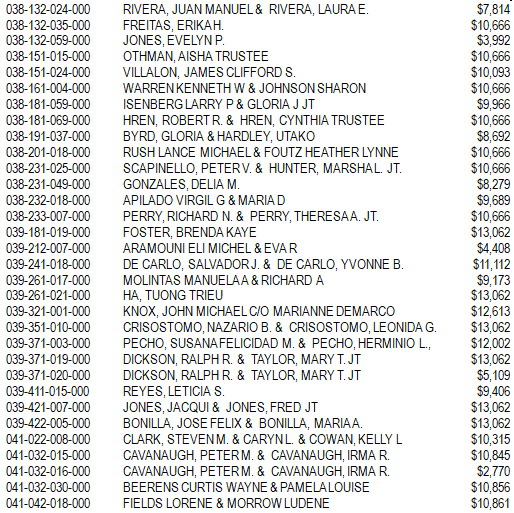

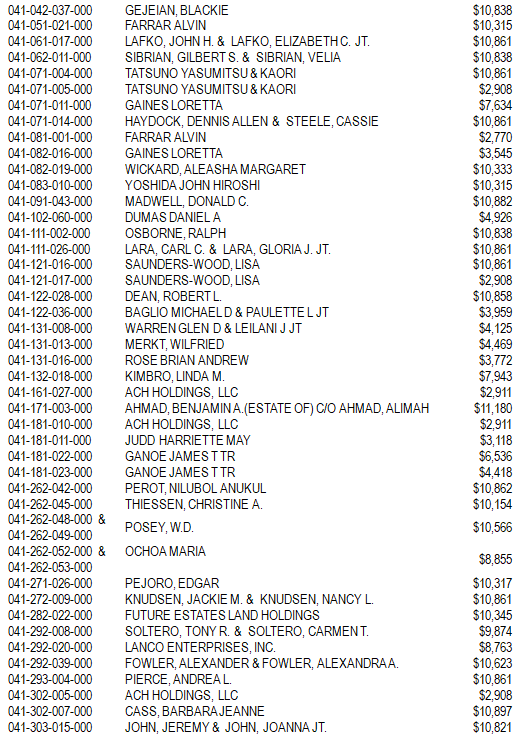

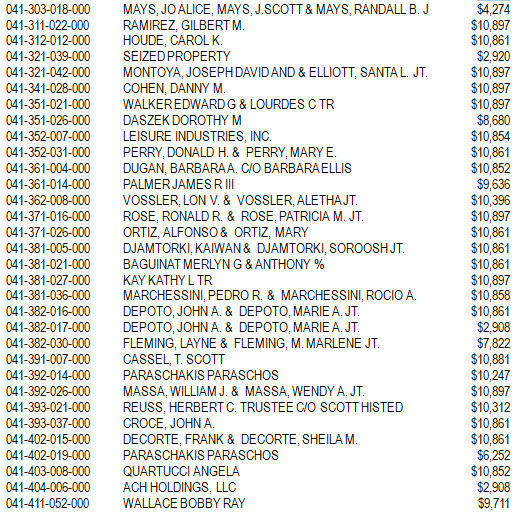

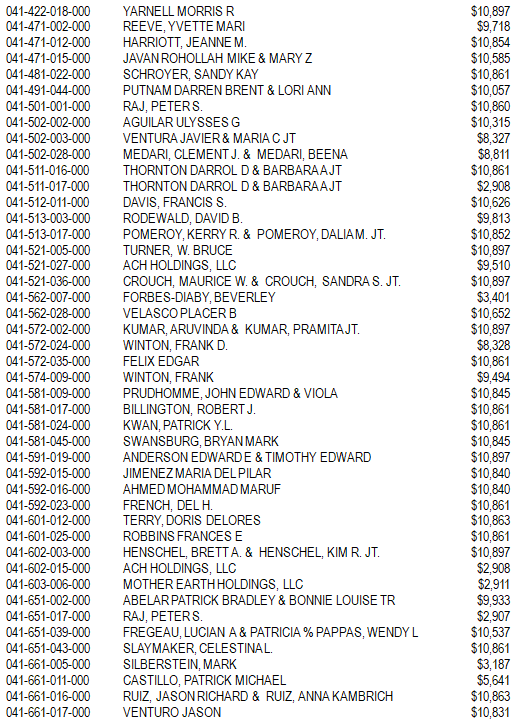

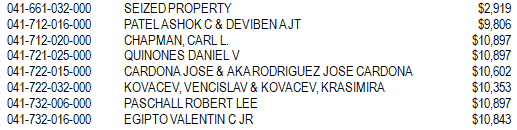

The properties that are the subject of this notice are situated in Modoc County, California, and are described as follows:

I certify (or declare), under penalty of perjury, that the foregoing is true and correct.

s/ Cheryl Knoch

Modoc County Tax Collector

Executed at Alturas, Modoc County on April 2, 2025.

Published in the Modoc County Record on April 10, 17 & 24, 2025.