FROM THE SALE OF TAX-DEFAULTED PROPERTY

MADE PURSUANT TO SECTION 4676, REVENUE

AND TAXATION CODE

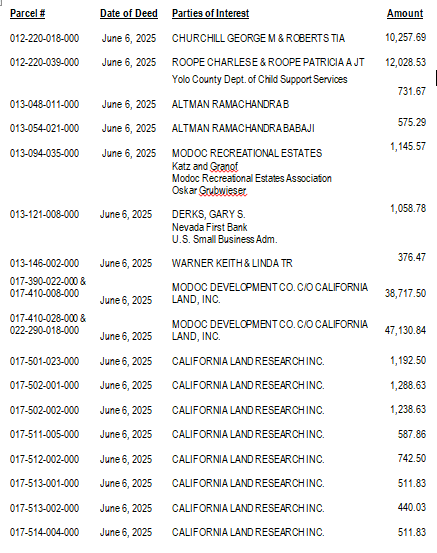

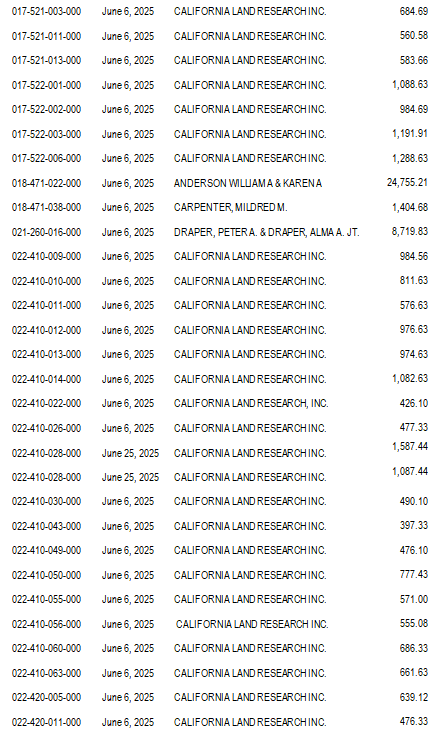

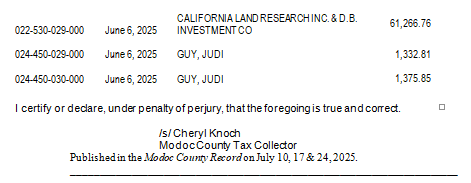

Excess proceeds have resulted from the sale of tax-defaulted property on May 16-19, 2025. The parties listed below may be parties of interest as defined by California Revenue and Taxation Code Section 4675 with rights to claim the excess proceeds.

All claims must be in writing and must contain sufficient information and proof to establish a claimant’s right to all or any part of the excess proceeds. Claims filed with the county more than one year after recordation of the tax collector’s deed to purchaser cannot be considered.

The county has searched for the parties of interest, as required by California Revenue and Taxation Code Section 4676. The parties of interest, as revealed in the search, the assessor’s parcel number, and the date the tax collector’s deed to purchaser was recorded are as follows:

For your convenience, claim forms and information regarding filing procedures may be obtained at the Modoc County Tax Collector’s Office, 204 South Court Street, Alturas, California 96101, or by calling (530) 233-6223 between 8:30am to 12:30pm and 1:00pm to 5:00pm, Monday through Friday, except holidays.